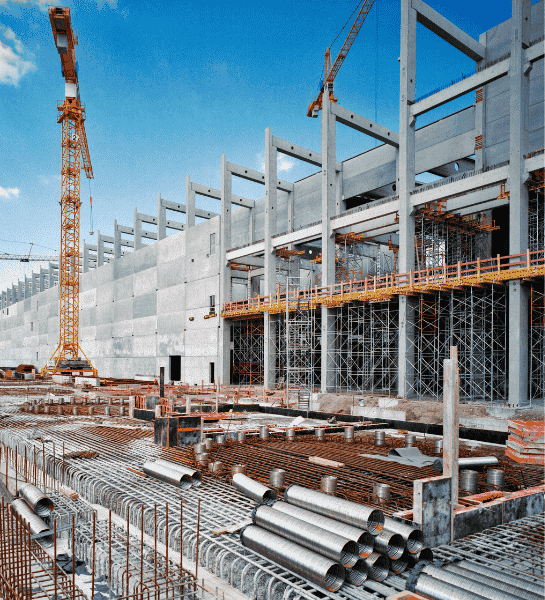

Low-Cost & Specialist Construction Accountant

Managing finances in the construction sector is unique and complex. From project-based accounting to understanding industry-specific tax laws, construction companies need more than a typical accountant – they need a specialist in a range of accounting & bookkeeping services.

At MH Services, we provide affordable and expert accounting services within the construction industry. We understand the unique challenges construction businesses face, whether you’re managing cash flow on a small renovation project or handling accounts for large-scale developments, we solve problems and make the right decision.

Results-Driven Construction Accounting Services

Specialist Accounting & Tax

We’re HMRC experts when it comes to accounting. We specialise in contractors, construction work, subcontractors, limited companies and tradesperson to maximize tax reliefs and keep your business compliant, giving you a competitive financial edge.

CIS - Construction Industry Schemes

Navigating CIS numbers doesn’t have to be a headache. We are preparing and submitting returns, deductions and sole trader verifications, ensuring you stay compliant and penalty-free. Our experience expertise in the construction means a hassle-free CIS process.

We Understand Your Business

Construction is unique, and so are our range of accounting services. From payroll, VAT returns and tax affairs to project expenses, we meet financial needs with tailored support, giving you control to keep building confidently while we manage the numbers.

We Support Small to Large Construction Businesses

=> Construction Tax Return from £199/year

Filing tax returns can be daunting, especially with the complexities of the construction industry. Our team specializes in tax returns for contractors, subcontractors, and construction firms, ensuring all eligible deductions and reliefs are maximized.

We understand the unique challenges of project-based income, CIS deductions, and industry-specific expenses, giving you confidence that your taxes are filed accurately and on time. Our expertise helps reduce your tax liability while ensuring full compliance with HMRC regulations.

Benefits of working with us:

- – Maximized tax relief and deductions tailored to construction

- – Timely and accurate filing to avoid penalties

- – Expert understanding of construction-specific tax rules

- – Seamless handling of CIS and project-based income

=> Self Assessment for construction projects £149

Self-assessment can be time-consuming and confusing, especially in the construction sector, where you may have project-based income or aren’t sure which expenses qualify. We handle the entire self-assessment process from start to finish, ensuring your finances are fully optimized.

We’ll identify all allowable expenses, minimize your tax liability, and submit everything to HMRC on your behalf, taking the stress off your shoulders. Our team understands the specific tax implications related to construction, so you can focus on your projects with peace of mind.

Benefits of working with us:

- – Timely filing to avoid late penalties

- – Expert identification of all construction-related expenses

- – Stress-free submission and communication with HMRC

- – Comprehensive management of project income and expenses

=> Bookkeeping for construction from £299/year

In the construction industry, keeping track of your finances year-round is essential for staying compliant with tax obligations. Our bookkeeping services are designed specifically for contractors and construction firms, offering seamless management of your project-based income and expenses.

Whether you’re managing contracts, CIS deductions, or equipment expenses, we’ll ensure your books are accurate and up-to-date. With our support, you can stay organized and avoid the last-minute rush before tax deadlines.

Benefits of working with us:

- – Real-time tracking of project income and expenses

- – No last-minute stress before tax deadlines

- – Clear financial visibility for smarter business decisions

- – Streamlined financial record-keeping, simplifying tax filings

=> Payroll for construction sectors from £229/year

Whether you’re a self-employed contractor, run a Ltd company, or manage a construction crew, we take the hassle out of payroll. Our payroll services are tailored for the construction sector, ensuring that everyone is paid correctly and on time, no matter the project size.

From processing wages to managing PAYE, National Insurance contributions, and pension schemes, we handle it all efficiently—without the high fees typically charged by chartered accountants. We understand the industry’s unique demands and provide flexible solutions that scale with your business.

Benefits of working with us:

- – Timely and error-free payments for all staff and subcontractors

- – Compliance with UK employment and tax regulations

- – Hassle-free payroll management for teams of any size

- – Accurate processing of PAYE, NI, and pensions

=> VAT Registration for construction companies £99

If your construction business has reached the VAT threshold or you’re considering voluntary registration, we’ll guide you through every step of the VAT registration process. Our accountants manage everything from initial registration to ongoing VAT returns, ensuring your compliance with ease.

We’ll advise you on the best VAT approach for your business, helping you optimize your tax position and stay aligned with industry requirements. Trust our team to handle the complexities of VAT, so you can focus on building your projects.

Benefits of working with us:

- – Expert advice on when to register for VAT

- – Smooth, hassle-free VAT registration and setup

- – Construction-specific VAT strategies to enhance tax efficiency

- – Ongoing management of VAT returns and deadlines

Satisfied Construction Companies

Mike has been our dedicated accountant in Manchester for 10 years. Answers any question, super reliable & efficient as well as genuinely friendly payroll service. Highly recommended for tax efficiency to any sole trader.

The bookkeeping services we received are fantastic. We had some issues in the past and needed help as my limited company has grown. Very patient & responsive accountants & client managers. Recommend their services

Mike has done wonders and sorted our bank account, payroll and I wanted to let you know I really appreciate all you’ve done at such short notice. Everything is up to date and I received the best accounting services in Manchester and a client manager.

If you need to grow and need a high level of service, I can strongly recommend using MH Services for accounting needs to subcontractors. Great accountancy, tax planning. All HMRC refunds are taken care of for such a low fee.

Mike has been sorting out my accounts for some years now; his accounting expertise and knowledge of the tourism industry are incredible. Highly recommend for accountancy service registered in England.

I’m a small business owner and have worked with Mike’s tax advisors in central London for many years. He’s been extremely helpful, easy to work with and flexible. Recommended for making tax digital and accounting records.

I’ve been using MHS for a few years now. Helpful and always at the end of the phone for catch-ups. Recommending for sole traders that own business and have various business needs and complex tax.

Mike has been my local London accountant for over 10 years and I have referred many of my friends and colleagues to him. He is an expert accountant for running a small business with reliable services.

High-class taxation assistance with a down-to-earth approach. I’ve always found Mike to be an incredibly knowledgeable, helpful and professional accountant near me for running a business. Would highly recommend him.

Construction Sector FAQs

What is the role of an accountant?

An accountant helps manage your finances by overseeing income, expenses, and tax obligations. For the construction sector, they provide specialized support, such as handling CIS compliance, VAT reclaims, Xero payroll, and project cost tracking to keep your business profitable and compliant.

Is it a legal requirement to have an accountant?

No, it’s not legally required to have an accountant. However, construction accounting can be complex, and having an accountant helps ensure you stay compliant with tax laws, avoid penalties, and make informed financial decisions. Also, specialist accountants like MH Services can offer advice and guidance on basic accounting.

Do I need an accountant if I am self-employed?

While it’s not mandatory, an accountant can be very beneficial for self-employed individuals in construction. They can help you manage CIS, claim expenses, and handle tax returns, allowing you to focus on your building projects rather than your finances or accounting needs.

Can I run a business without an accountant?

Yes, but having an accountant saves time and reduces the risk of costly mistakes. An accountant’s expertise is particularly valuable in construction, where tax rules and compliance requirements can be complex. So whether you are a plumber, electrician or a subcontractor, making the right business decision is important.

How long does it take to get a CIS number?

The Construction Industry Scheme (CIS) number is essential for contractors and subcontractors in the UK construction industry. Typically, once you’ve registered for the CIS with HM Revenue & Customs (HMRC), it can take up to two weeks to receive your CIS number. If you haven’t received your number within this timeframe, it’s advisable to contact HMRC for an update.

Get in touch on how to hire a construction accountant today!

Imperial Court, 2 Exchange Quay, M5 3EB

25 Wilton Road, Victoria, SW1V 1LW

mhservices@mail.com

+44 7969 625797